hayal gücünüz kadar geniş fırsatlarla dolu!

yatırımlarınızı yönetmeye şimdi başlayın.

YATIRIM

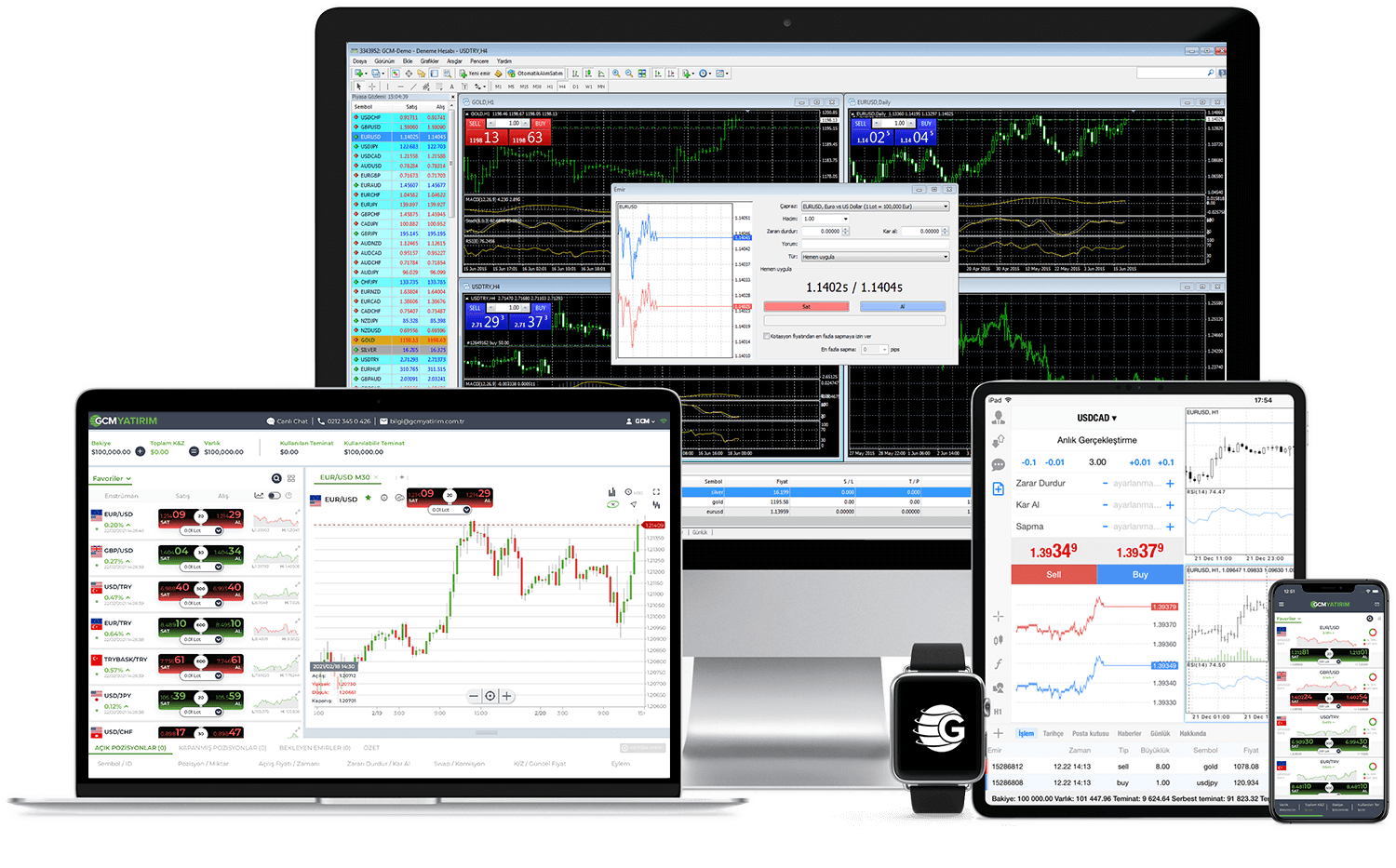

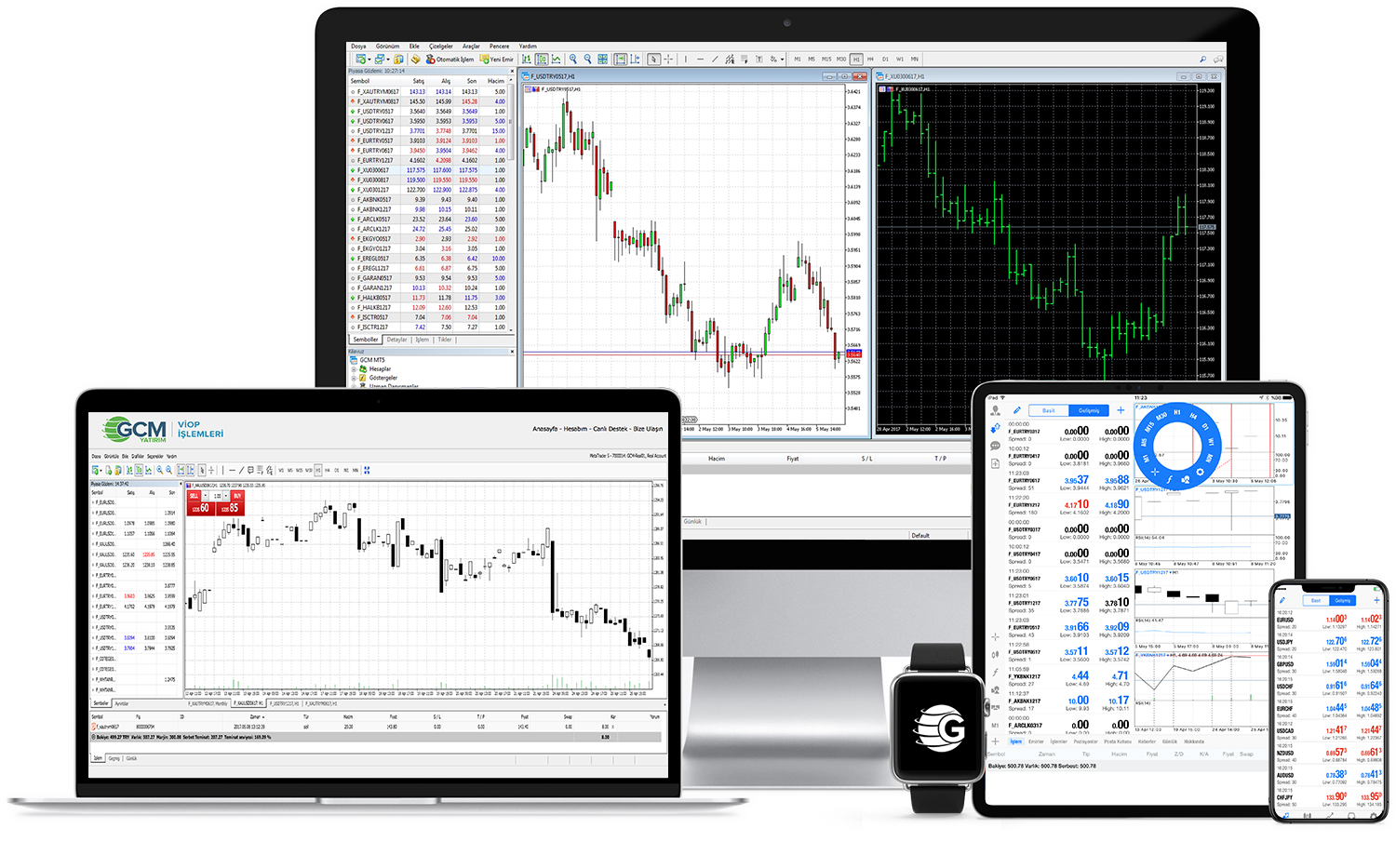

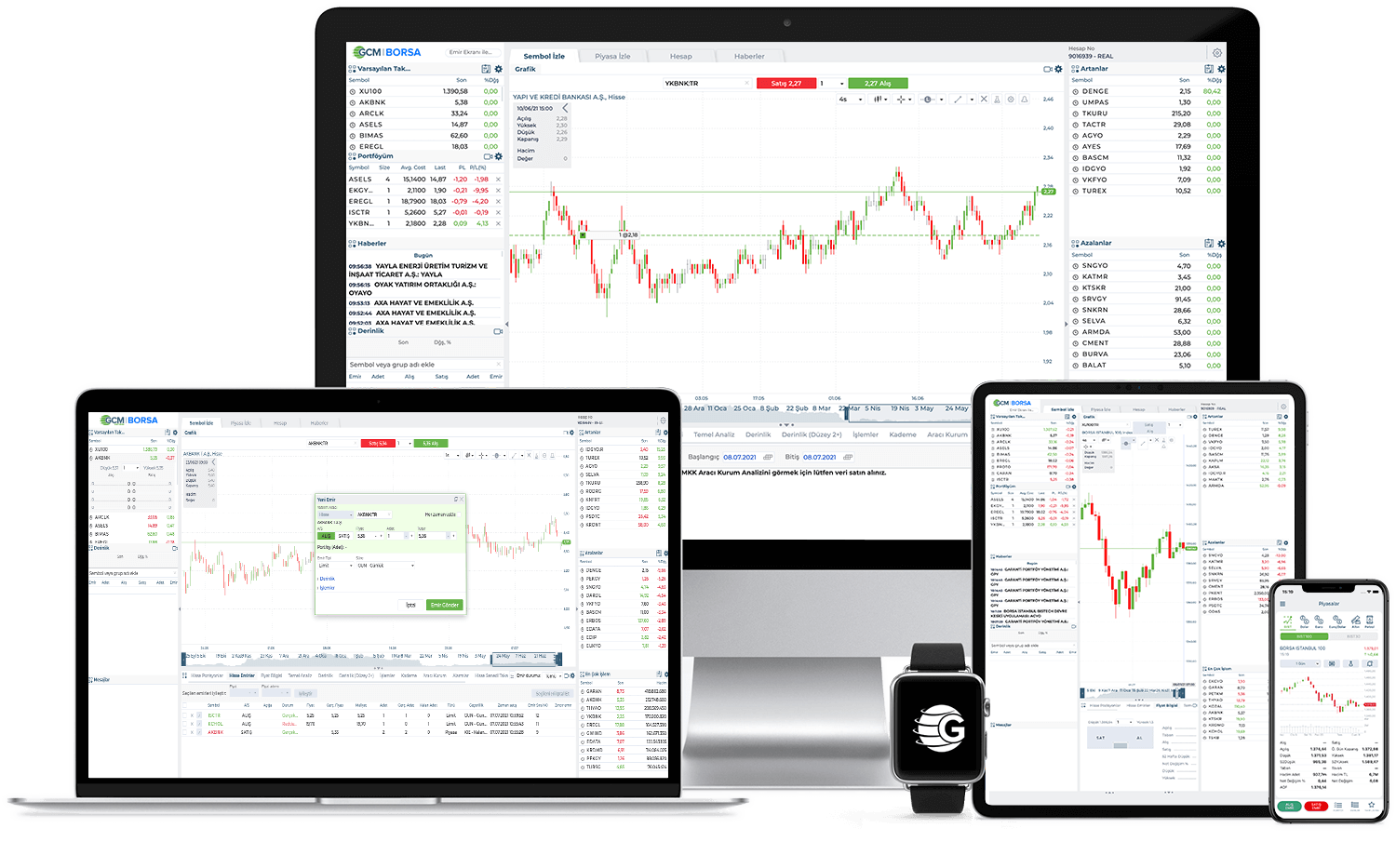

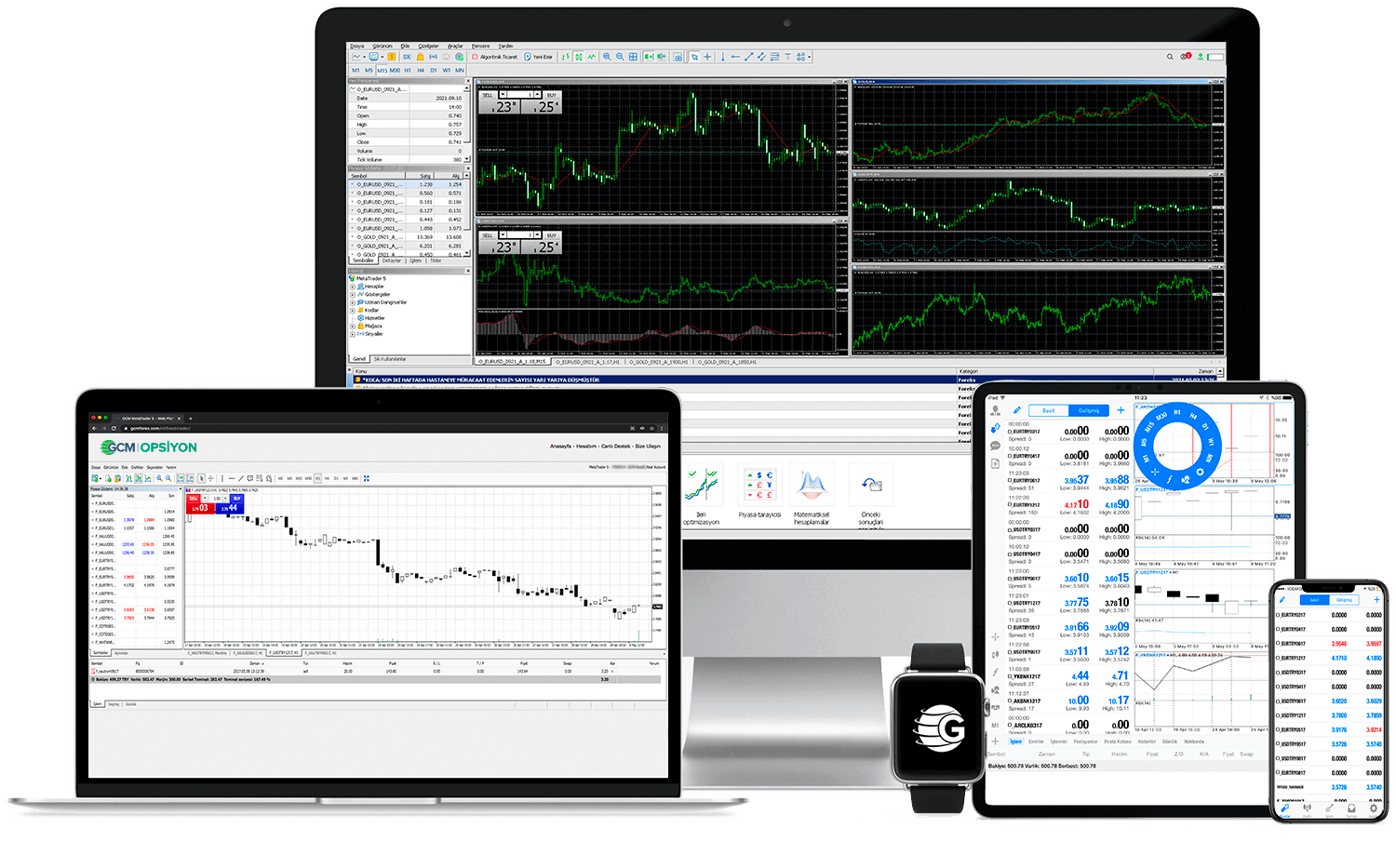

MENKUL DEĞERLER A.ŞSon teknolojileri kullanan gelişmiş online Forex, Opsiyon, VİOP ve Borsa işlem platformlarımız sayesinde müşterilerimiz tüm anlık finansal verilere, piyasa analizlerine ve ihtiyaç duyulan diğer bilgilere hızlı ve güvenli bir şekilde ulaşıp işlem yapabilmekte, yaratıcı mobil iletişim kolaylıklarıyla zaman ve mekan sınırlarından kurtulmaktadır.

Bugün 600 Milyon TL ödenmiş sermayemiz, 860 Milyon TL öz sermayemiz ve dünya standartlarındaki teknolojik altyapımızla Türk sermaye piyasalarının önemli aktörlerinden biriyiz ve geleceği şekillendiren her gelişmenin yakın takipçisiyiz.

Global Piyasalarda 500’den Fazla Yatırım Aracı

Yatırım stratejilerinize en uygun piyasayı seçin, dilediğiniz yatırım aracı ile yatırıma başlayın.

Forex, VİOP ve Borsa işlemleri GCM Yatırım'da!

ARAŞTIRMA & ANALİZ

Yatırım stratejilerinize rehber olabilecek forex, viop, borsa analizleri; araştırma raporları ve uzman görüşleri

Forex Analizi

18.04.2024 - 15:09Yurtiçi Analiz

18.04.2024 - 07:48GCM EĞİTİM

Zengin bir finans eğitim kütüphanesi, online eğitimler, seminerler, forex & viop kitapları ve videolar ile benzersiz eğitim desteği!

GCM YATIRIM

GCM Yatırım Menkul Değerler A.Ş. 2012 yılında Türk Sermaye Piyasalarında yerini almış ödüllü ve lisanslı bir yatırım kuruluşudur. Genel borsa aracılık hizmetlerimiz içinde özellikle kaldıraçlı alım satım işlemleri başta olmak üzere FOREX, VİOP, HİSSE ve OPSİYON işlemlerine aracılık özel uzmanlık alanlarımızdır. On binlerce yatırımcımız ile Türkiye’nin lider yatırım kuruluşları arasında yer alıyoruz.